Main risks and uncertainties to which Reply S.p.A and the Group are exposed

The Reply Group adopts specific procedures in managing risk factors that can have an influence on company results. Such procedures are a result of an enterprise management that has always aimed at maximizing value for its stakeholders putting into place all necessary measures to prevent risks related to the Group activities. Reply S.p.A., as Parent Company, is exposed to the same risks and uncertainties as those to which the Group is exposed, and which are listed below. The risk factors described in the paragraphs below must be jointly read with the other information disclosed in the Annual Report.

External risks

Risks associated with general economic conditions

The informatics consultancy market is strictly related to the economic trend of industrialized countries where the demand for highly innovative products is greater. An unfavourable economic trend at a national and/or international level or high inflation could alter or reduce the growth of demand and consequently could have negative effects on the Group’s activities and on the Group’s economic, financial and earnings position. It should also be noted that Russia’s invasion of Ukraine and the recent crisis between Israel and Palestine that began on October 7, 2023, creates uncertainties and tensions, particularly within the Eurozone. Although the relative evolutions and impacts are still uncertain and difficult to assess, the intensification of war hostilities, ongoing geopolitical tensions and trade war, including the imposition of international economic sanctions against companies, banks and Russians, could have significant negative repercussions on the global, international and Italian economy, on the performance of the financial markets and on the energy sector.

Risks related to the evolution of ICT-related services

The ICT consulting services sector in which the Group operates is characterised by rapid and profound technological changes and by a constant evolution of the mix of professional skills and expertise to be pooled in the provision of the services themselves, with the need for continuous development and updating of new products and services, and a prompt go to market. Therefore, the future development of the Group’s activities will also depend on its ability to foresee technological developments and the content of its services, also through significant investments in research and development activities, or through effective and efficient extraordinary operations.

Risks associated with competition

The ICT market is highly competitive. Competitors could expand their market share squeezing out and consequently reducing the Group’s market share. Moreover, the intensification of the level of competition is also linked with possible entry of new entities endowed with human resources and financial and technological capacities in the Group’s reference sectors, offering largely competitive prices which could condition the Group’s activities and the possibility of consolidating or amplifying its own competitive position in the reference sectors, with consequent repercussions on business and on the Group’s economic, earnings and financial situation.

Risks associated with changes in client needs

The Group’s solutions are subject to rapid technological changes which, together with the growing or changing needs of customers and their own need for digitalisation, could translate into requests for the development of increasingly complex activities that sometimes require excessive commitments that are not economically proportionate, or could result in the cancellation, modification or postponement of existing contracts. This could, in some cases, have repercussions on the Group’s business and on its economic and financial situation.

Risks associated with segment regulations

The Group is subject to the laws and regulations applicable in the countries in which it operates, such as, among the main ones, regulations on the protection of occupational health and safety, the environment and the protection of intellectual property rights, tax regulations, regulations on the protection of privacy, the administrative liability of entities pursuant to Legislative Decree No. 231/01 and responsibilities under Law 262/05. The Group operates in accordance with applicable legal requirements and has established processes to ensure that it is aware of the specific local regulations in the areas in which it operates and of regulatory changes as they occur. Violations of these regulations could result in civil, tax, administrative and criminal sanctions, as well as the obligation to carry out regularisation activities, the costs and responsibilities of which could adversely affect the Group’s business and its results.

Climate risks

Reply’s business model considers its employees as the maximum expression of its resources, as the Group specialises in consulting, system integration and digital services, and is dedicated to the conception, design and development of solutions based on new communication channels and digital media.

However, the risks associated with:

climate, both chronic and acute with reference to temperature, wind, water and soil and therefore to possible extreme events, such as fires, floods, hurricanes

other phenomena, such as earthquakes

uncertainties arising from armed conflicts or terrorist attacks

may have a direct impact on the Group and its supply chain.

With reference to the main climatic risks for the company, any significant damage to the Group’s offices could have an impact on critical processes, such as the e-mail service, however these impacts are subject to analysis of the aspects of business continuity and are safeguarded by appropriate security and organizational measures to preserve the business from disruptions. The occurrence of a serious accident would hardly have a significant negative impact on the Group’s activities. Extreme weather events that have occurred in the last decade have caused minor impacts on business activities based on digital and cloud services, for which the home-based working approach is widespread and well established and constitutes a good strategy to mitigate the unavailability of locations, for example in the event of an extreme climatic event. It is important to remember that the majority of the services provided by the Group are based on systems and data centres of Customers or Third Parties, outside the direct responsibility of Reply, which does not manage any data centre of significant size. Diversely, the risk of generating negative impacts on the climate by the Group is mainly linked to the ability to adopt effective measures to reduce emissions that partly depend also on the energy that the company buys to manage its activities and that can be produced from fossil fuels or renewable sources. In this case, the Russian invasion of Ukraine generates negative impacts on the security of supply and, while making clear the need for an energy transition, causes the use of fossil fuels in the short term. This context could make it more difficult to achieve the defined environmental targets. This could be compounded by reputational risk, such as the difficulty of attracting and retaining customers, employees, business partners and investors if Reply fails to meet its climate protection targets. The measures taken to prevent and mitigate environmental risks are the ISO14001-certified environmental management system and all initiatives to reduce greenhouse gas emissions related to the Group’s operations (mainly due to locations and business travel), which can lead in the short term to an increase in capital expenditures before obtaining financial benefits in the long term and the use of renewable energy. In most cases, however, the Group does not own all the buildings where the offices are located: this condition could hinder in terms of feasibility, time and costs the implementation of energy efficiency measures that should generate an improvement in environmental performance. The ESG Team, with the support of the local Operations functions, collects and analyses environmental data, periodically monitors indicators and helps to create awareness and train employees on these issues thanks to events and internal communication initiatives, coordinated by the Social Network function.

Our most relevant suppliers share a similar exposure as Reply.

Internal risks

Risks associated with key management and loss of know-how

The Group’s success is largely due to certain key figures who have contributed in a decisive way to its development, such as the Chairman, the Chief Executive Officer and the executive directors of the Parent Company Reply S.p.A.. Reply also has a management team with many years of experience in the sector, which plays a decisive role in the management of the Group’s activities. The loss of the services of one of the aforementioned key figures without adequate replacement, as well as the inability to attract and retain new and qualified personnel, could have a negative impact on the Group’s prospects, maintenance of critical know-how, activities and economic and financial results. The Management believes, in any event, that the Company has an operational and managerial structure capable of ensuring continuity in the management of corporate affairs.

Risks associated with relationship with client

The Group offers consulting services mainly to medium and large size companies operating in different market segments (Telco, Manufacturing, Finance, etc.). A significant part of the Group’s revenues, although in a decreasing fashion in the past years, is concentrated on a relatively limited number of clients. If such clients were lost this could have an adverse effect on the Group’s activities and on the Group’s economic, financial and earnings position.

Risks associated with internationalization

The Group, with an internationalization strategy, could be exposed to typical risks deriving from the execution of its activities on an international level, such as changes in the political, macro-economic, fiscal and/or normative field, along with fluctuations in exchange rates. These could negatively influence the Group’s growth expectations abroad.

Risks related to group development

The constant growth in the size of the Group presents new management and organisational challenges. The Group constantly focuses its efforts on training employees and maintaining internal controls to prevent possible misconduct (such as misuse or non-compliance with laws or regulations on the protection of sensitive or confidential information and/or inappropriate use of social networking sites that could lead to breaches of confidentiality, unauthorised disclosure of confidential company information or damage to reputation). If the Group does not continue to make the appropriate changes to its operating model as needs and size change, if it does not successfully implement the changes, and if it does not continue to develop and implement the right processes and tools to manage the business and instil its culture and core values in its employees, the ability to compete successfully and achieve its business goals could be compromised.

Risks related to acquisitions and other extraordinary operations

The Group plans to continue to pursue strategic acquisitions and investments to improve and add new expertise, service offerings and solutions, and to enable expansion into certain geographic areas and other markets. Any investment made as part of strategic acquisitions and any other future investment in Italian or international companies may involve an increase in complexity in the Group’s operations and there is no guarantee that such investments will generate the expected return on the acquisition or investment decision and that they will be properly integrated in terms of quality standards, policies and procedures in a manner consistent with the rest of the Group’s operations. The integration process may require additional costs and investments. Inadequate management or supervision of the investment made may adversely affect the business, operating results and financial matters.

Risks related to non-fulfilment of contractual commitments

The Group develops high-tech, high-value solutions; the underlying contracts, which may involve both internal staff and external contractors, may provide for the application of penalties for failure to meet agreed deadlines and quality standards. The application of such penalties could have negative effects on the Group’s economic and financial results and reputation. However, the Group has taken out insurance policies, deemed adequate, to protect itself against risks arising from professional liability for an aggregate annual maximum amount deemed adequate in relation to the underlying risk. However, if the insurance coverage is inadequate and the Group is required to pay damages in excess of the maximum amount provided, the Group’s financial position, results of operations and cash flows could be materially adversely affected.

Risks related to key partnerships

In order to offer the most suitable solutions to differing customer needs, the Group has established important partnerships with leading global vendors. The business that the Group conducts through these partnerships may decline or not grow for a number of reasons, as the priorities and objectives of technology partners may differ from those of the Group and they are not prohibited from competing with the Group or entering into closer agreements with its competitors. Decisions the Group makes with respect to a technology partner may affect the ongoing relationship. In addition, technology partners may experience reduced demand for their technology or software, which could decrease the related demand for the Group’s services and solutions. The risk of failing to adequately manage and successfully develop relationships with key partners, or of failing to foresee and establish effective alliances in relation to new technologies, could adversely affect the ability to differentiate services, offer cutting-edge solutions to customers or compete effectively in the market, with possible consequent repercussions on the business and on the economic and financial situation.

Risks related to the protection of intellectual property rights

The Group’s success depends, in part, on its ability to obtain intellectual property protection for its proprietary platforms, methodologies, processes, software and other solutions. The Group relies on a combination of confidentiality, non-disclosure and other contractual agreements, and patent, trade secret, copyright and trademark laws and procedures to protect its intellectual property rights. Even where we obtain intellectual property protection, the Group’s intellectual property rights cannot prevent or discourage competitors, former employees or other third parties from reverse engineering their own solutions or proprietary methodologies and processes or independently developing similar or duplicate services or solutions. In addition, the Group may unwittingly infringe the rights of others and be liable for damages as a result. Any claims or litigation in this area could cost time and money and lead to damage the Group’s reputation and/or require it to incur additional costs to obtain the right to continue offering a service or solution to its customers. The occurrence of such risks could adversely affect the Group’s competitive advantage and market positioning, its economic, financial and capital position, as well as its reputation and prospects for future business development.

Cyber security, data management and dissemination risks

The Group’s business relies on IT networks and systems to process, transmit and store electronic information securely and to communicate with its employees, customers, technology partners and suppliers. As the scale and complexity of this infrastructure continues to grow, not least due to the increasing reliance on and use of mobile technologies, social media and cloud-based services, and as increasingly more of our employees are working remotely, the risk of security incidents and cyber-attacks increases. Such breaches could result in the shutdown or disruption of the Group’s systems and those of our customers, technology partners and suppliers, and the potential unauthorised disclosure of sensitive or confidential information, including personal data. In the event of such actions, the Group could be exposed to potential liability, litigation and regulatory or other actions, as well as loss of existing or potential customers, damage to brand and reputation, and other financial losses. In addition, the costs and operational consequences of responding to violations and implementing corrective measures could be significant. To date, there hasn’t been a cybersecurity attack that has had a material effect on the Group, although there is no guarantee that there won’t be a material impact in the future. As the business and cyber security landscape evolves, the Group may also find it necessary to make significant additional investments to protect data and infrastructure. However, if the insurance coverage, which includes IT insurance, is inadequate and the Group is required to pay damages in excess of the maximum amount provided, the Group’s financial position, results of operations and cash flows could be materially adversely affected.

Risks in terms of social and environmental responsibility and business ethics

In recent years, the growing community focus on social, environmental and business ethics issues, as well as the evolution of national and international regulations, have given impetus to the disclosure and measurement of non-financial performance, which is now fully included among the qualifying factors of corporate management and competitive capacity of a company. In this regard, socio-environmental issues and business ethics are increasingly integrated into the strategic choices of companies and are increasingly attracting the attention of various stakeholders concerned with sustainability issues. The Group is committed to managing its business activities with a particular focus on respect for the environment, social issues, labour relations, the promotion of human rights and the fight against corruption, contributing to the spread of a culture of sustainability in respect of future generations. Failure to adequately address these issues could subject the Group to risks of sanctions as well as reputational risks. For a more specific discussion of sustainability/ESG risks, please refer to the Disclosure of Non-Financial Information (NFI), published on the Reply website in the ”Investors” section.

Financial risks

Credit risk

For business purposes, specific policies are adopted to assure its clients’ solvency. With regards to financial counterparty risk, the Group does not present significant risk in creditworthiness or solvency.

The Group’s exposure to credit risk is the potential losses that could result from non- fulfilment of the obligations assumed by both commercial and financial counterparties. In order to measure this risk over time, as part of the impairment of its financial assets (including trade receivables), the Group has applied a model based on expected credit losses pursuant to IFRS 9. This exposure is mainly due to general economic and financial items, the possibility of specific insolvency situations of some debtor counterparties and more strictly technical- commercial or administrative elements. The maximum theoretical exposure to credit risk for the Group is the book value of financial assets and trade receivables. The risk related to trade receivables is managed through the application of specific policies aimed at ensuring the solvency of customers. Provisions to the allowance for doubtful accounts are made specifically on creditor positions with specific risk elements. On creditor positions which do not have such characteristics, provisions are made on the basis of the average default estimated on the basis of statistical indicators.

Liquidity risk

The group is exposed to funding risk if there is difficulty in obtaining finance for operations at any given point in time. The cash flows, funding requirements and liquidity of the Group’s companies are monitored or centrally managed under the control of the Group Treasury, with the objective of guaranteeing effective and efficient management of capital resources (maintaining an adequate level of liquid assets and funds obtainable via an appropriate committed credit line amount). The difficult economic and financial context of the markets requires specific attention as regards the management of liquidity risk and in such a way that particular attention is given to shares tending to generate financial resources with operational management and to maintaining an adequate level of liquid assets. The Group therefore plans to meet its requirements to settle financial liabilities as they fall due and to cover expected capital expenditures by using cash flows from operations and available liquidity, renewing or refinancing bank loans.

Exchange rate and interest rate risk

The Group entered into most of its financial instruments in Euros, which is its functional and presentation currency. Although it operates in an international environment, it has limited exposure to fluctuations in the exchange rates. The exposure to interest rate risk arises from the need to fund operating activities and M&A investments, as well as the necessity to deploy available liquidity. Changes in market interest rates may have the effect of either increasing or decreasing the Group’s net profit/(loss), thereby indirectly affecting the costs and returns of financing and investing transactions. The interest rate risk to which the Group is exposed mainly derives from bank loans; to mitigate such risks, the Group, when necessary, has used derivative financial instruments designated as ”cash flow hedges”. The use of such instruments is disciplined by written procedures in line with the Group’s risk management strategies that do not contemplate derivative financial instruments for trading purposes.

Tax risk

The risk of any changes in tax law and its application or interpretation could have a negative or positive impact on the Group’s results of operations, affecting the effective tax rate. The Company adheres to the National Tax Consolidation scheme pursuant to articles 117/129 of the Consolidated Income Tax Act (TUIR). Reply S.p.A., the Parent Company, acts as the consolidating company and determines a single taxable income for the Group of companies participating in the Tax Consolidation, benefiting from the possibility of offsetting taxable income with tax losses in a single declaration. The tax risk limitation measures put in place by Management, in terms of verifying the adequacy and correctness of tax compliance, obviously cannot completely exclude the risk of tax audits.

Review of the group’s economic and financial position

Foreword

The financial statements commented on and illustrated in the following pages have been prepared on the basis of the Consolidated financial statements as at 31 December 2023 to which reference should be made, prepared in compliance with the International Financial Reporting Standards (”IFRS”) issued by the International Accounting Standards Board (”IASB”) and adopted by the European Union, as well as with the provisions implementing Article 9 of Legislative Decree No. 38/2005.

Trend of the period

The Reply Group closed 2023 with a consolidated turnover of €2,118.0 million, an increase of 12.0% compared to €1,891.1 million in 2022.

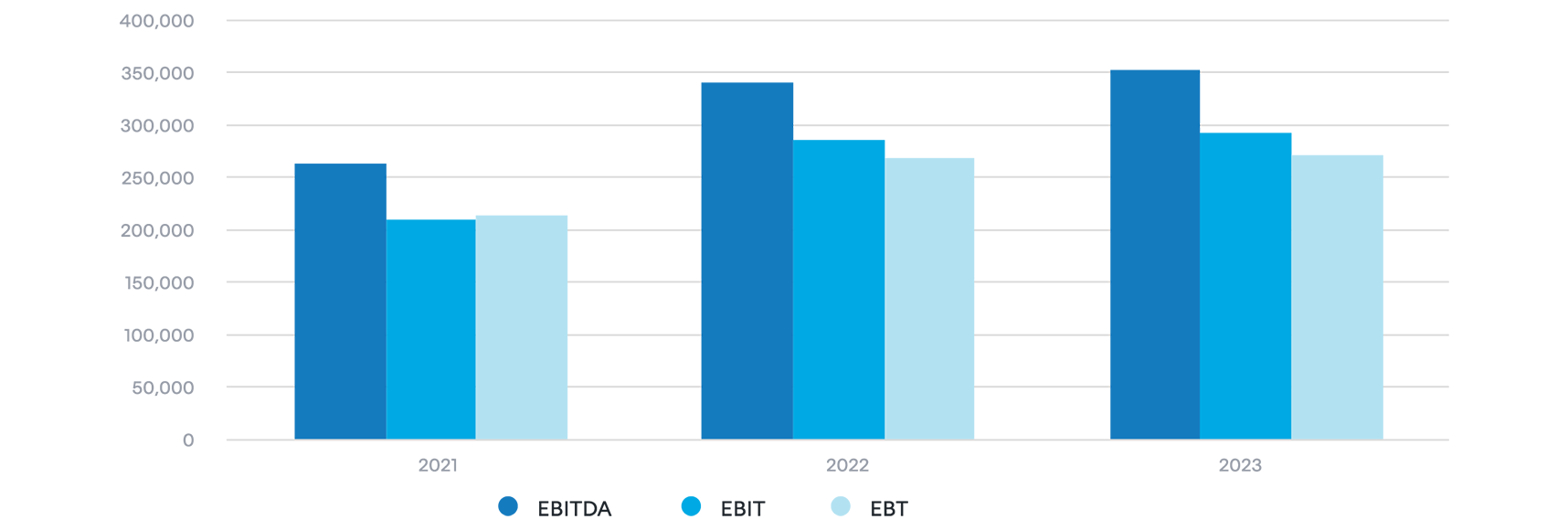

All indicators are positive for the period. Consolidated EBITDA was €352,1 million, an increase of 3.5% compared to €340,3 million at December 2022 (growth is 20% net of the COVID funds released in 2022).

EBIT, from January to December, was at €292,7 million, which is an increase of 2.5% compared to €285,5 million at December 2022 (growth is 22.7% net of the COVID funds released in 2022).

The Group’s net profit was a €186,7 million. In 2022, the corresponding value was €191,0 million.

Following the results achieved in 2023, the Reply Board of Directors decided to propose a dividend distribution of €1 per share to the next Shareholders’ Meeting, which will be payable on 22 May 2024, with the dividend date set on 20 May 2024 (record date 21 May 2024).

As at 31 December 2023, the Group’s net financial position has been positive at €204,9 million (€70,6 million at 31 December 2022). As at 30 September 2023, the net financial position was positive at €189,7 million. 2023 was the year in which the world became definitively aware that a great new revolution was just around the corner: the advent of artificial intelligence. Reply was able to ride this moment of great discontinuity by closing a growing financial year, but above all by establishing itself among the new leaders in the sector. This positioning was possible because Reply, in 2023, was able to capitalise on years of investment made in artificial intelligence, an area where we began operating with our first competence centres as early as 2013. This know-how within the group has allowed us, in a few months, not only to set up dedicated AI units within all the group companies, but above all to specialise more than 20 companies on the introduction of artificial intelligence into the main industrial sectors.

The future that lies ahead is still to be written. In a short time, we will be living in a union of automation, artificial intelligence, digital interfaces and connected objects. In front of us, there is a great opportunity and at the same time a challenge that, as Reply, we intend to seize and transform into new spaces of growth for our Group.

Reclassified consolidated income statement

Reply’s performance is shown in the following reclassified consolidated statement of income and is compared to corresponding figures of the previous year:

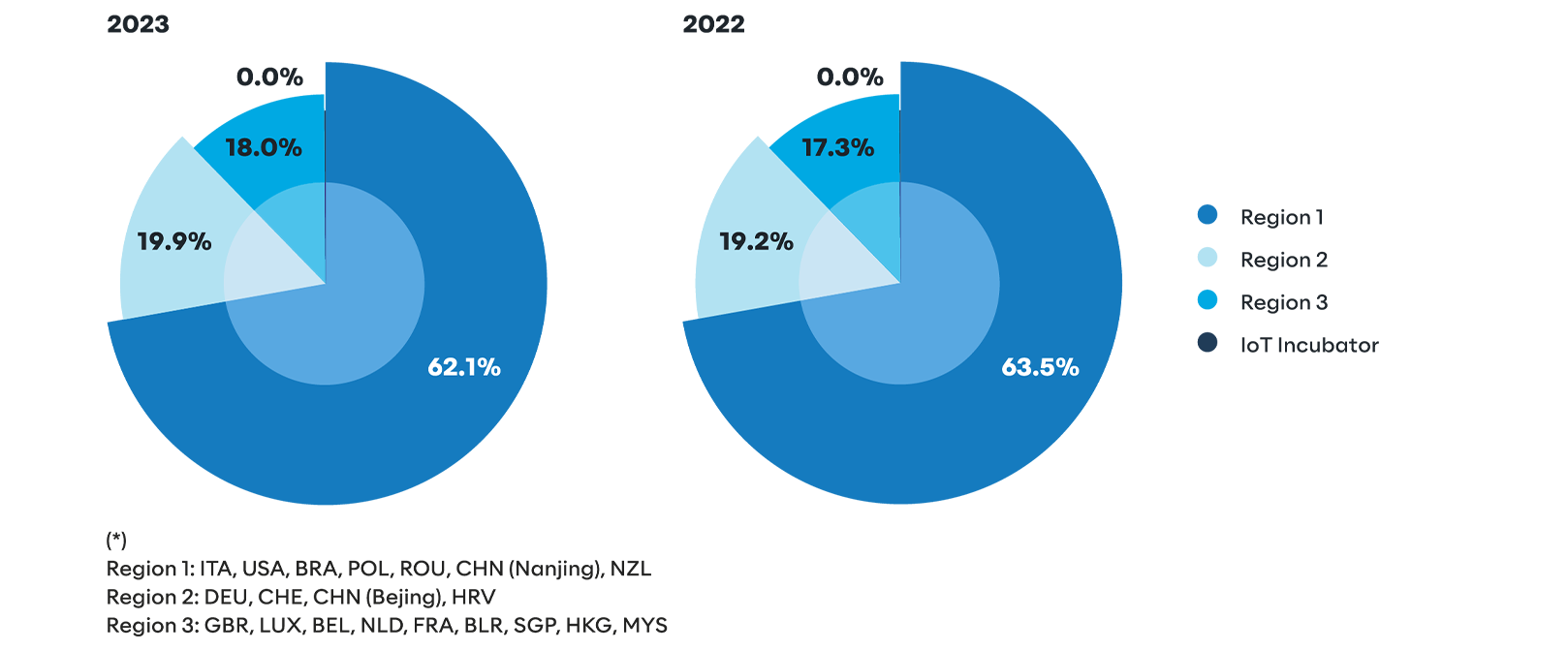

REVENUES BY REGION (*)

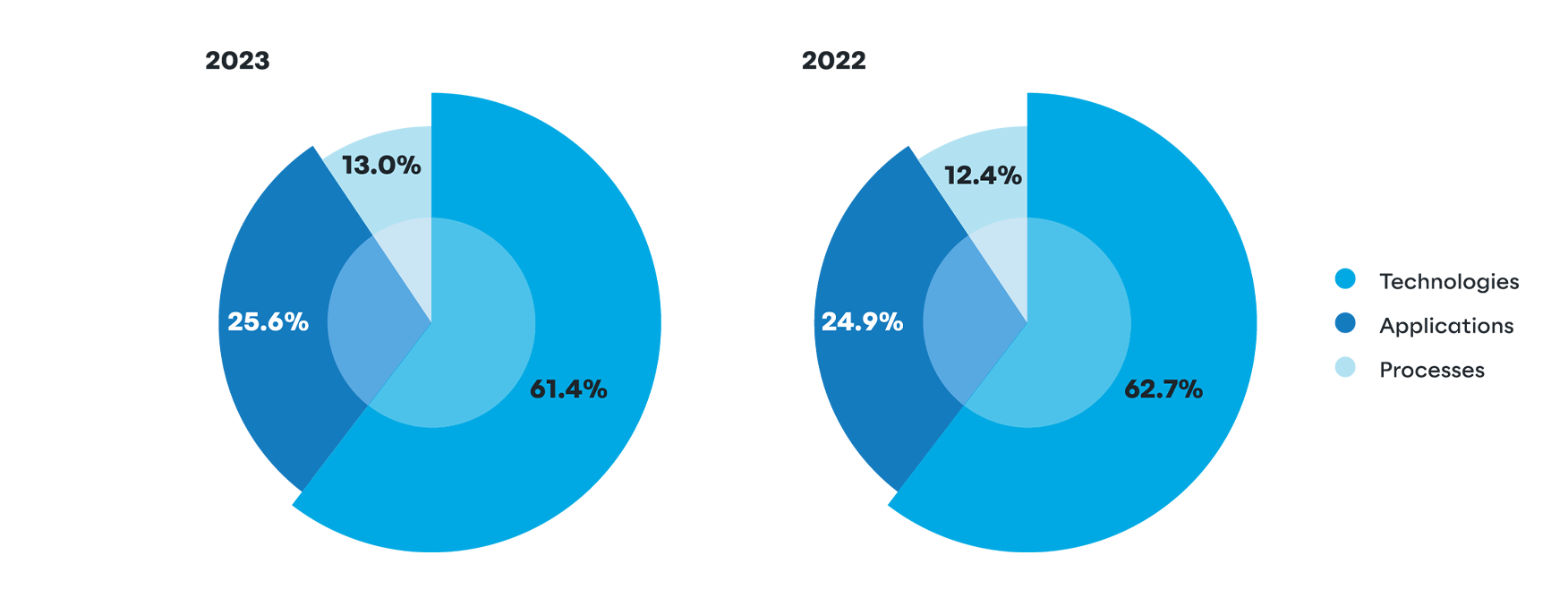

REVENUES BY BUSINESS LINES

TREND IN KEY ECONOMIC INDICATORS

Analysis of the financial structure

The Group’s financial structure is set forth below as at 31 December 2023, compared to 31 December 2022:

Net invested capital on 31 December 2023, amounting to 911,826 thousand Euros, was funded by Shareholders’ equity for 1,116,723 thousand Euros and by available overall funds of 204,898 thousand Euros.

It is to be noted that net invested capital includes Due to minority shareholders and Earn-out for a total of 114,368 thousand Euros (141,502 thousand Euros at 31 December 2022); this item is not included in the net financial managerial position. For the ESMA net financial indebtedness see note 30.

The following table provides a breakdown of net working capital:

NET FINANCIAL MANAGERIAL POSITION AND CASH FLOWS STATEMENT

Change in the item cash and cash equivalents is summarized in the table below:

The complete consolidated cash flow statement and the details of cash and other cash equivalents net are set forth below in the financial statements.

Alternative performance indicators

In addition to conventional financial indicators required by IFRS, presented herein are some alternative performance measures, in order to allow a better understanding of the trend of economic and financial management.

These indicators that are also presented in the periodical Interim management reports must not, however, be considered as replacements to the conventional indicators required by IFRS.

Set forth below are the alternative performance indicators used by the Group with relevant definitions and basis of calculation:

EBIT: corresponds to the “Operating margin“

EBITDA: Earnings before interest, taxes, depreciation and amortization and is calculated by adding to the Operating margin the following captions:

Amortization and depreciation

Write-downs

Other unusual costs/(income)

EBT: corresponds to the Income before taxes

Net financial managerial position:represents the financial structure indicator and is calculated by adding the following balance sheet captions:

Cash and cash equivalents

Financial assets (short-term)

Financial liabilities (long-term) including those referable to the adoption of IFRS 16

Financial liabilities (short-term) including those referable to the adoption of IFRS 16

Other non-recurring (costs)/revenues are related to events and transactions that due to their nature do not occur continuously in normal operations.

Significant operations in 2023

No M&A operations have occurred during the financial year ended December 31, 2023.

Reply on the stock market

Reply share performance

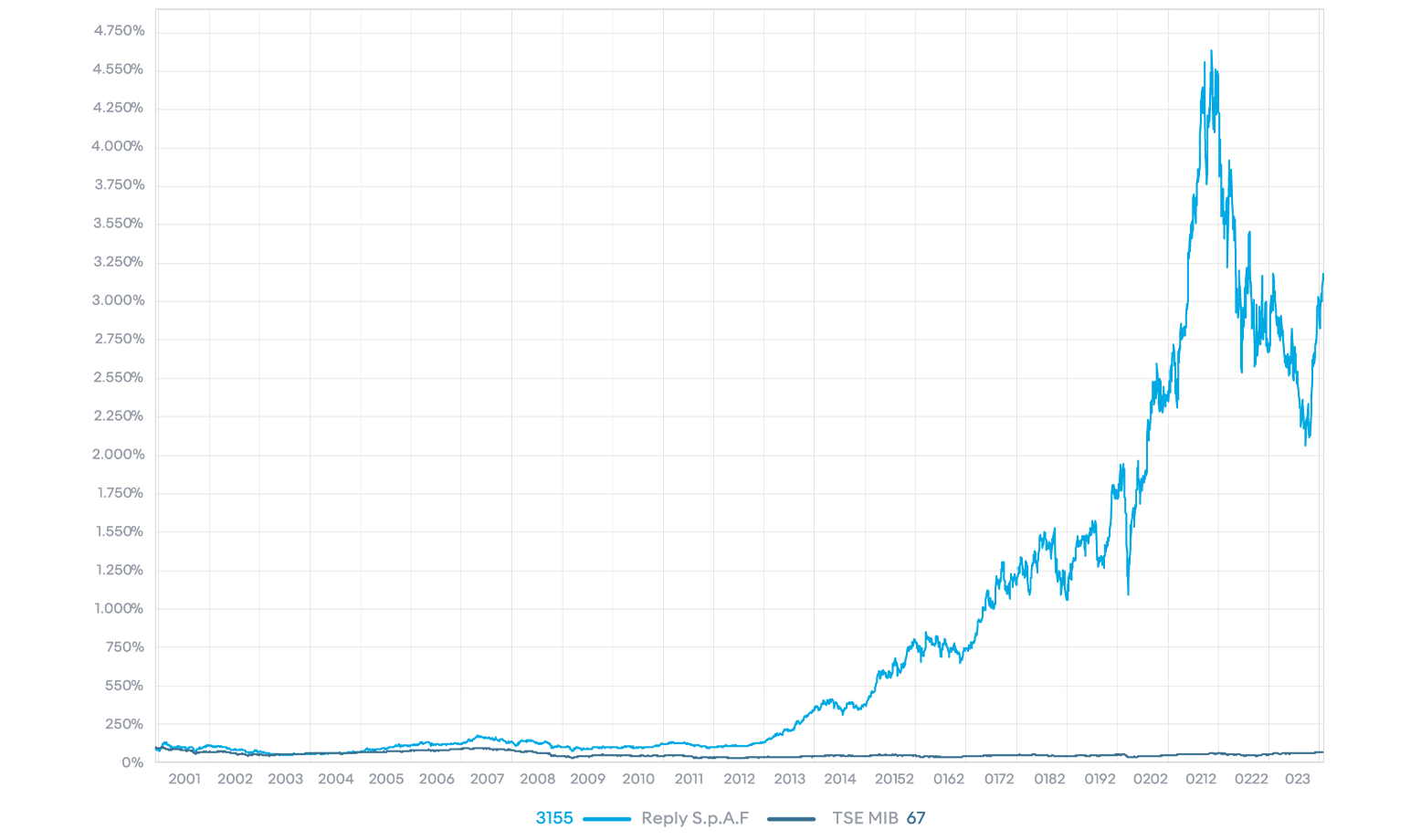

The starting point for 2023 was anything but promising and simple: global economic growth was weak and even stagnated in some countries. Interest rates remained high, as inflation rates remained high, global uncertainties were growing, as were geopolitical risks, difficulties with international supply chains and suddenly high energy prices. The war in the Middle East and the Red Sea added other areas of international conflict in 2023. However, the global economy proved to be surprisingly robust and resilient. The continued interest rate hikes by the central banks, which have been increasingly successful in curbing inflation, certainly played an important role in the ultimately largely positive development of the financial markets. Particularly when the first signs of an end to the cycle of interest rate hikes emerged and hopes of interest rate cuts became more concrete, the stock markets gained new momentum, especially as economic indicators also gave cause for hope. In this environment, various indices even managed to set new records in mid-December. A large part of these gains can be attributed to the rally since the interim low in mid-October. For those who invested in large stocks included in the leading indices, it was a much better year than for investors focussing on smaller and medium-sized stocks. Shares from the US market were also more profitable than European stocks. There were extreme winners, such as stocks benefiting from the new hype topic of ”artificial intelligence”, and strong underperformers, such as many stocks categorised as cyclical. The current macroeconomic situation conflicts with a secular trend that remains intact: digitalisation will not be held back by any current or future crisis. Companies that manage to utilise artificial intelligence in such a way that it does not become an afterthought, but instead generates real efficiency gains, will be rewarded with rising corporate profits. Gradually, even the last few should have understood that digitalisation does not simply mean moving mountains of paper to a virtual cloud. True digitalisation transforms business models. It frees up capacity for new thinking and brings completely new ideas to light. The financial year 2023 started well for Reply recovering a part of the losses incurred in the previous year. The share entered an upward corridor, with the share price rising to its 2023 maximum of EUR 127.30 on 3 February 2023. Until the beginning of July 2023, the share showed a sideward tendency. During summer the share saw strong reductions ending in a minimum share price of EUR 82.40 on 26 September 2023. The financial year was saved by the strong upward development of the Reply share of more than 40% in November and December 2023. The share closed the year 2023 at EUR 119.50. Reply’s market capitalisation returned to EUR 4.5 billion. In January 2024, the upward development of the Reply share continued. At the time of writing this chapter, the Reply share was trading at EUR 128.50, with a market capitalisation of EUR 4.8 billion. In 2023, Reply’s performance was in the midfield compared to the various country and sector indices and peer group companies.

Taking December 6, 2000, the date of the Reply IPO, as a reference, the Italian main index MIB gained 28% in 2023 and stood at 66% of its starting value. In the same period, Reply increased its IPO value by 2,888%. The outperformance of the Reply share versus the MIB reduced in 2023 but is unchanged significant with more than 2,900%. Comparable results were calculated by an Equita study named ”Italian Champions”. In a 10 years’ timeframe (from October 1, 2012 to September 30, 2023) Reply scored third with a 10 years’ total return of 796%.

Share liquidity

In 2023 the lower valuation of Reply was considered as a potential entry point for the stock. Accordingly, the trading activity of the Reply share increased significantly. The number of traded shares increased by 25% to 12.7 million shares (10.2 million shares in 2022). On the other hand, the trading volume remained basically stable (+0.6%) amounting to EUR 1.3 billion. The impact of the lower share price compensated for the increase in the number of shares traded. The improvement of the Reply share price - especially the strong performance of the 4th quarter, had a substantial impact on the valuation multiples seen in Reply. Compared to its peers - defined as a group of digital native companies, diversified IT Service companies and agencies, Reply is now trading between 22% (Enterprise Value/EBITDA) and 29% (Price/ Earnings Ratio) above the peer valuations. In terms of enterprise value to revenue, Reply was valued 22% higher than the peer group average at the end of 2023.

Dividend

Performance-related remuneration is an essential pillar of Reply’s partnership-based business model. Like employees, Reply’s shareholders should participate in the Group’s sustainable operational performance in the form of dividends. Every year this principle is balanced with the need for internal financing to finance Reply’s investments (in new start- up companies, new technologies and potential acquisitions to further elaborate Reply’s offering portfolio in Germany, UK, US and France as Reply’s strategic regions). In 2023 Reply achieved earnings per share of EUR 5.01, a decrease of 2.3% compared to 2022. For the financial year 2023, the corporate bodies of Reply propose to the shareholders’ meeting to approve the payment of a dividend of EUR 1.00 (dividend 2022: EUR 1.00). Referred to the share price of Reply at the end of 2023 this corresponds to a dividend yield of 0.84%. Assuming the approval of the shareholders’ meeting, Reply will pay to its shareholders a dividend amount of EUR 37.3 million. For financial year 2022 EUR 37.3 million were distributed.

The subsequent table gives an overview of the main parameters of the Reply share and their substantial developments during the last 5 years.

The shareholders base

At the end of 2023, 42.9% of Reply’s shares were owned by Reply’s founders. Institutional shareholders owned 50% of the shares at the end of 2022, while retail shareholders owned 7% of the shares. Reply’s institutional shareholder base has undergone some significant changes. US investors, the main investor country in Reply, reduced their ownership in Reply to 26% of the institutional shareholding compared to 31% in the previous year. Italian investors continued to increase their positions and are now the second largest investors, holding approximately 24% (2022: 22%). UK investors increased their position to 12% of institutional holdings. French investors were stable at 10% of the shares. According to the Shareholders’ Ledger, on the date of this report the shareholders that directly or indirectly, also through an intermediary person, trust companies and subsidiaries, hold stakes greater than 3% of the share capital having the right to vote are the following:

Analysts

In 2023, the number of analysts regularly covering the Reply share remained unchanged at 8. While one Italian coverage ended Reply welcomed a new French analyst among its group of analysts. In line with the strong development of the Reply share - especially in the 4th quarter, the analyst votes changed gradually. 3 ratings were on ”outperform” while 5 analysts took a ”neutral” stance on the share. The average price target for Reply shares by analysts in January 2024 was 118 euros.

Dialog with the capital markets

An active and open communication policy, which ensures the timely and continuous dissemination of information, is an essential part of Reply’s IR strategy. In 2023 Reply increased its already high level of activity with the capital markets significantly. During 20 conferences and 5 road shows, Reply actively explained its equity story. The number of virtual meetings with investors increased by 58%. In parallel Reply increased the number of physical investor meetings by 166%. The majority of communication contacts were with French, Italian and UK investors. The highest increases were seen with UK and Italian investors where the contacts grew more than 84% in 2023. The number of brokers involved in Reply’s IR activities increased from 11 to 13. In April 2023 Reply was selected as the winner of the Financial Attractiveness Award 2023 for listed companies, granted by Arca Fondi, GEA and Harvard Business Review. The prize is awarded to companies that, in addition to their financial and earnings results, have distinguished themselves for the quality of their governance, management independence and structured and verifiable management processes. The award, now in its sixth annual edition in 2023, is not only a testimony to excellence but also a stimulus for Italian entrepreneurs to be inspired by best practices in our country and to consider the opportunities arising from the correct use of their own and third-party financial resources in the development of their companies.

The Parent Company Reply S.p.A.

Introduction

The tables presented and disclosed below were prepared on the basis of the financial statements as at 31 December 2023 to which reference should be made, prepared in accordance with the International Financial Reporting Standards (”IFRS”) issued by the International Accounting Standards Board (”IASB”) and endorsed by the European Union, as well as with the regulations implementing Article 9 of Legislative Decree No. 38/2005.

Reclassified income statement

The Parent Company Reply S.p.A. mainly carries out the operational coordination and the technical and quality management services for the Group companies as well as the administration, finance and marketing activities. As at 31 December 2023, the Parent Company had 108 employees (109 employees in 2022). Reply S.p.A. also carries out commercial fronting activities (pass-through revenues) for some major customers, whereas delivery is carried out by the operational companies. The economic results achieved by the Company are therefore not representative of the Group’s overall economic trend and the performances of the markets in which it operates. Such activity is instead reflected in the item Pass-through revenues of the Income Statement set forth below.

The Parent Company’s income statement is summarized as follows:

Revenues from operating activities mainly refer to:

royalties on the Reply trademark for 58,424 thousand Euros (53,611 thousand Euros in the financial year 2022);

shared service activities in favour of its subsidiaries for 60,154 thousand Euros (57,110 thousand Euros in the financial year 2022);

management services for 15,634 thousand Euros (14,585 thousand Euros in the financial year 2022).

Operating income 2023 marked a positive result of 9,091 thousand Euros after having deducted amortization expenses of 4,445 thousand Euros (of which 326 thousand Euros referred to tangible assets, 3,467 thousand Euros to intangible assets and 651 thousand Euros related to RoU assets arising from the adoption of IFRS 16). Financial income amounted to 20,835 thousand Euros and included interest income on bank accounts for 33,817 thousand Euros, interest expenses for 11,403 thousand Euros mainly relating to financing for the M&A operations and the non-effective portion of the IRS for negative 1,044 thousand Euros. Such result also includes net positive exchange rate differences amounting to 2,778 thousand Euros. Income from equity investments which amounted to 164,087 thousand Euros refers to dividends received from subsidiary companies in 2023. Losses on equity investments refer to write-downs and losses reported in the year by some subsidiary companies that were considered to be unrecoverable. Net income for the year ended 2023, amounted to 161,130 thousand Euros after income taxes of 9,343 thousand Euros.

Financial structure

Reply S.p.A.’s financial structure as at 31 December 2023, compared to that as at 31 December 2022, is provided below:

The net invested capital on 31 December 2023, amounting to 276,727 thousand Euros, was funded by Shareholders’ equity in the amount of 731,290 thousand Euros and by available overall funds of 454,563 thousand Euros. Changes in balance sheet items are fully analyzed and detailed in the explanatory notes to the financial statements.

Net financial managerial position

The Parent Company’s net financial managerial position as at 31 December 2023, compared to 31 December 2022, is detailed as follows:

Change in the net financial managerial position is analyzed and illustrated in the explanatory notes to the financial position.

Reconciliation of equity and profit for the year of the parent company

In accordance with Consob Communication no. DEM/6064293 dated 28 July 2006, Shareholders’ equity and the Parent Company’s result are reconciled below with the related consolidated amounts.

Corporate Governance

The Corporate Governance system adopted by Reply - issuer listed at Euronext Satr Milan - adheres to the Corporate Governance Code for Italian Listed Companies issued by Borsa Italiana S.p.A..

In compliance with regulatory obligations the annually drafted ”Report on Corporate Governance and Ownership Structures” contains a general description of the corporate governance system adopted by the Group, reporting information on ownership structures and compliance with the Code, including the main governance practices applied and the characteristics of the risk management and internal control system also with respect to the financial reporting process. The aforementioned Report, related to 2023, is available on the website www.reply.com. The Corporate Governance Code is available on the website of Borsa Italiana S.p.A. https://www.borsaitaliana.it/comitato-corporate-governance/codice/2020.pdf.

Declaration of non-financial data

The company, in accordance with the provisions of article 5 (3) (b) of Legislative Decree No 254/2016, has prepared the consolidated declaration of a non-financial nature which constitutes a separate report. The consolidated declaration of non-financial data 2023, drafted in accordance with the ”GRI Standards” reporting standard, is available on the Group website www.reply.com.

Other information

Research and development activities

Reply offers high-technology services and solutions in a market where innovation is of primary importance.

Reply considers research and continuous innovation a fundamental asset in supporting clients with the adoption of new technology. Reply dedicates resources to Research and Development activities in order to project and define highly innovative products and services as well as possible applications of evolving technologies. In this context, Reply has developed its own platforms.Reply has important partnerships with major global vendors so as to offer the most suitable solutions to different company needs. Specifically, Reply boasts the highest level of certification amongst the technology leaders in the Enterprise sector.

Human resources

Human resources constitute a primary asset for Reply which bases its strategy on the quality of products and services and places continuous attention on the growth of personnel and in-depth examination of professional necessities with consequent definitions of needs and training courses. The Reply Group is comprised of professionals originating from the best universities and polytechnics. The Group intends to continue investing in human resources by bonding special relations and collaboration with major universities with the scope of attracting highly qualified personnel. The people who work at Reply are characterized by enthusiasm, expertise, methodology, team spirit, initiative and the capability of understanding the context they work in and of clearly communicating the solutions proposed. The capability of imagining, experimenting and studying new solutions enables more rapid and efficient innovation. The group intends to maintain these distinctive features by increasing investments in training and collaboration with universities. At the end of 2023, the Group had 14,798 employees compared to 13,467 in 2022.

General Data Protection Regulation (GDPR)

The governance model of the Group privacy policy reflects what is required by the existing code for the protection of personal data and the European Regulation 679/16 (GDPR). Privacy fulfilments are managed uniformly at the Reply Group level in order to maintain adequate levels of internal coherence and to facilitate external relations, in particular with authorities, customers and suppliers.

To ensure compliance the Group has adopted a GDPR program which provides several activities including:

updating the Group privacy organizational model;

designation for each Region of a Data Protection Officer;

reorganization of the central Privacy & Security Team;

preparation of contact link with the DPO and the Privacy & Security Team through a central ticketing system;

updating of e-learning and induction material related to data protection content;

mandatory GDPR and ICT Security training at all business levels;

assessment of privacy and security of IT central services;

drafting of Records of the treatment activities;

development and dissemination of new fundamental processes for GDPR, updating of existing data protection policies, development and dissemination of guidelines and contractual templates for GDPR;

periodic internal audits on the Companies for the correct application of the GDPR requirements in the work for Customers and in the engagements of Suppliers.

Transactions with related parties and group companies

During the period, there were no transactions with related parties, including intergroup transactions, which qualified as unusual or atypical. Any related party transactions formed part of the normal business activities of companies in the Group. Such transactions are concluded at standard market terms for the nature of goods and/or services offered, these transactions took place in accordance with the internal procedures containing the rules aimed at ensuring transparency and fairness, under Consob Regulation 17221/2010.

The company in the notes to the financial statements and consolidated financial statements provides the information required pursuant to Art. 154-ter of the TUF [Consolidated Financial Act] as indicated by Consob Reg. no. 17221 of 12 March 2010 and subsequent Consob Resolution no. 17389 of June 23, 2010, indicating that there were no significant transactions concluded during the period as defined by Art. 4, paragraph 1, let a) of the aforementioned regulation that have significantly affected the Group’s financial or economic position. The information pursuant to Consob communication of 28 July 2006 is presented in the annexed tables herein.

Treasury shares

At the balance sheet date, the Parent Company holds 133,192 treasury shares amounting to 17,122,489 Euros, nominal value equal to 17,315 Euros; at the balance sheet item net equity, the company has posted an unavailable reserve for the same amount. At the balance sheet date, the Company does not hold shares of other holding companies.

Financial instruments

In relation to the use of financial instruments, the company has adopted a policy for risk management through the use of financial derivatives, with the scope of reducing the exposure to interest rate risks on financial loans. Such financial instruments are considered as hedging instruments as they can be traced to the object being hedged (in terms of amount and expiry date).

In the notes to the financial statements, more detail is provided to the above operations.

Pillar 2

In December 2021, the Organisation for Economic Co-operation and Development (OECD) published the document ”Tax Challenges Arising from the Digitalisation of the Economy - Administrative Guidance on the Global Anti-Base Erosion Model Rules (Pillar Two)”.

In this context, the European Commission has adopted EU Directive no. 2022/2523 on global minimum taxation for multinational groups of companies, with an obligation for Member States to transpose EU provisions into their national law by 31 December 2023 and to apply them from tax periods starting from that date The Pillar Two rules aim to ensure, through a system of common rules, a minimum level of effective taxation of not less than 15% in each jurisdiction in which a multinational group operates.

In transposition of Directive no. 2022/2523, Italy issued Legislative Decree 209/2023 which introduced and regulated the minimum supplementary tax (so-called Top Up Tax) payable by the parent company in relation to shareholdings in companies located in low-tax countries, provided that this country has not in turn introduced a national minimum tax (so-called Qualified Domestic Top Up Tax). The national provisions apply with reference to tax periods starting from 31 December 2023 and, therefore, for Reply from 2024.

Reply has analysed the levels of implementation of the Pillar Two rules in the different jurisdictions in which it operates: the local implementation provisions, where already introduced, will apply from the financial year 2024 or later. Therefore, there are no current tax charges to be recognised this year. In this context, Reply has started the assessment of the effects deriving from the application of the Pillar Two rules at national and foreign levels: however, due to the complexity and novelty of the rules, as well as their application uncertainty, the quantitative effects cannot, to date, be reasonably estimated. The analyses and evaluations preparatory to the application of Pillar Two for Reply will continue during the year 2024.

Events subsequent to 31 December 2023

On the afternoon of 28 February 2024, Reply S.p.A. was informed of a preventive seizure order issued on 8 February 2024 by the Court of Milan. With this decree, amounts totalling approximately Euro 322 million were seized from the companies and individuals allegedly involved in various capacities, of which €7,949,544.98 to Reply S.p.A. From what is indicated in the decree, the alleged crime is the one referred to in art. 640-ter, paragraphs 1 and 3 of the Criminal Code, in the period 2017-2019 According to what emerges from the Decree, a fraudulent mechanism would have been put in place in relation to the telephone operator TIM, which would have made it possible to operate unsolicited activations by users of so-called value-added services (VAS) offered by so-called Content Service Providers (CSPs), such as, for example, logos, ringtones, etc.; these unsolicited activations would have resulted in the charging of the relevant fee on users’ telephone credit and therefore would have entailed, through a revenue share mechanism, revenues for the subjects in the supply chain: from the telephone operator, to other operators, including CSPs (recipients of most of the residual revenues) and also to those who played purely commercial and technical roles (such as Reply). The seizure order contains extracts from statements made by certain persons who allegedly involved an employee of one of the companies of the Reply Group in the aforementioned fraudulent scheme. The proceedings are still at the preliminary investigation stage.

Outlook on operations

2023 was a year in which the world became aware that a new great revolution is upon us. In the last year, everyone has discovered the pervasiveness of Generative AI tools, being fascinated and partly subjugated by them. On the wave of this enthusiasm, there has been a natural and widespread tendency to overestimate what will happen in the next two years, but at the same time, there is a vast underestimation of what will happen in ten years.

In fact, today we are experiencing a first phase of great acceleration, in which, thanks to artificial intelligence, we simply think about improving what we already know how to do. In the second phase, which will begin in the next few years, we will do things that did not exist before, creating new activities. Finally, there will be a third phase in which new business models will be generated, now unimaginable, just as happened at the beginning of the century with the emergence of the new economy.

In any case, the directions of evolution of technology are now defined and touch all sectors, with artificial intelligence, AR/VR, robotics, cloud and cybersecurity positioning themselves as the new competitive levers on which most of the ICT investments of companies will focus in the coming months. Over the years, Reply has consolidated solid skills in these areas and where it intends to position itself as one of the main players.

At the same time, sustainability is another issue that has touched all sectors, becoming even more relevant in recent months in the choices of companies. As Reply, we feel a strong responsibility towards future generations and will continue to be committed to the environment to achieve the goals we have set ourselves of Carbon Neutrality in 2025 and net zero emissions by 2030. However, as a consulting firm, we know that the biggest contribution we can make to a just transition is to put our expertise at the service of clients, helping them manage the innovation aspects that support the transition and supporting them in how products and services are designed to be more efficient and sustainable.

Motion for the approval of the financial statement and allocation of the result for the financial year

The financial statements at year end 2023 of Reply S.p.A. prepared in accordance with International Financial Reporting Standards (IFRS), recorded a net income amounting to 161,129,698 Euros and net shareholders’ equity on 31 December 2023 amounted to 731,289,889 Euros thus formed:

The Board of Directors in submitting to the Shareholders the approval of the financial statements (Separate Statements) as at 31 December 2023 showing a net result of 161,129,698 Euros, proposes that the shareholders resolve:

to approve the financial statement (Separate Statements) of Reply S.p.A. which records net profit for the financial year of 161,129,698 Euros;

to approve the motion to allocate the net result of 161,129,698 as follows:

a unit dividend to shareholders amounting to 1.00 Euros for each ordinary share with a right, therefore excluding treasury shares, with payment date fixed on 22 May 2024, coupon cutoff date 20 May 2024 and record date, determined in accordance with Article 83-terdecies of Legislative Decree no. 58/1998 set on 21 May 2024;

having the Legal reserve reached the limit of one fifth of the share capital pursuant to article 2430 of the Italian Civil Code, the residual amount to be allocated to the Retained earnings reserve;

to approve, pursuant to Article 22 of the Articles of association, the proposal of the Remuneration Committee to distribute to Directors entrusted with operational powers, a shareholding of the profits of the Parent Company, to be established in the amount of 3,800,000 Euros.

Turin, 13 March 2024

/s/ Mario Rizzante

For the Board of Directors

The Chairman

Mario Rizzante

Report on Operations